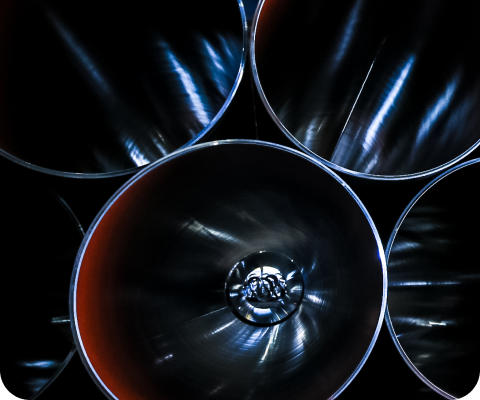

Металлургическая продукция и комплексные решения

для топливной энергетики, транспорта, строительства, вагоностроения и других отраслей

Совершенство продуманных решений

ОМК работает более чем в 30 регионах России, инициирует системные социальные и благотворительные проекты.

ОМК работает более чем в 30 регионах России, инициирует системные социальные и благотворительные проекты.

Продукция и услуги

Люди – главная ценность компании. Мы уважаем традиции металлургической отрасли страны и ежедневно совершенствуемся в мастерстве.

О компании

ОМК — одна из крупнейших промышленных компаний России и комплексный поставщик решений для экономики.

Система закупок SRM ОМК

В ОМК внедрили систему SRM (Supplier Relationship Management — управление взаимоотношениями с поставщиками). Это обеспечивает открытые и справедливые закупочные процедуры.

Пресс-релизы

- Все

- Продукция и сервисы

- Инвестиции и проекты

- Защита природы

- Устойчивое развитие

- Корпоративное управление

15.03.2024

Вагоноремонтная компания ОМК открыла два новых сервисных центра по ремонту кассетных подшипников

Связаться с нами

- Продажи

- Центральный офис

- Предприятия

- ОМК Маркет

Центральный офис ОМК

115184, Москва, Озерковская набережная, д. 28, стр. 2

Сообщите нам о случаях:

- хищений и мошенничества;

- коррупции и конфликтов интересов;

- нарушения этических норм;

- нарушения внутренних документов компании и законодательства;

- сокрытия производственных травм.